The Accounting Management System is an essential application that allows an organization to state the flow of money for internal and external review and auditing. It is the prime tool for evaluating the financial health of an organization and for meeting legal compliance. When you start a business, accounting software is the main thing that you need to have.

Managing your company’s capital can be a difficult task. That is why you need accounting software that can help you to track your currency as it flows in and out of your accounts. An accounting system deals with cash books, bank books, vouchers, journals, general ledgers, subsidiary ledgers, etc. This system also generates reports like trial balance, balance sheet, profit and loss accounts, income statement, etc.

This system is an efficient way to manage and monitor the workflow and resource process progress in the company and also keep track of your company’s financial situation.

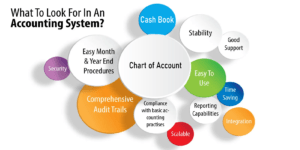

A good accounting management system has the following features:

Chart of account

A chart of accounts (COA) is a financial organizational tool that lists all the financial accounts included in the financial statement of a company. The chart of accounts comprises the name of each account listed, a brief report, and identification codes that are precise to each account. This tool provides expenditures, revenue, assets, equity, and liabilities so that viewers can rapidly get a sense of a company’s financial health. This is also called the “spinal cord” of an accounting system.

Voucher entry and editing

A voucher is a written document that will assist in the organization’s activities. Once the accounts are created, the user has only to enter the voucher. This feature helps to do hassle-free entries in a single voucher format, and you can also edit your previous voucher.

Print and preview the voucher

This feature allows you to print the report in the language of your choice and view it before printing by using the print preview mode.

Cash book

A cash book contains the cash transactions of a business. A general cash book has a single column, a double column, and a triple column. A company’s cash book is no longer done on paper or in Excel, but rather through a central portal. It’s easy to process, time-saving, secure and provides accurate financial statements. The Cash Book helps to track outgoings with integrated financial reports on how much money was spent in a given period of time.

Bank book

The bank book is the term of assets on a bank balance sheet that is expected to be held to maturity, usually consisting of customer loans, deposits, etc. It also includes derivatives that are used to hedge exposures arising from the bank’s book activity.

General ledge

A general ledger, also known as a nominal ledger, serves as a central repository of accounting data like accounts payable, accounts receivable, cash management, assets, etc. A general ledger is the master set of accounts that summarizes all transactions within an entity. This feature is used to aggregate information into the financial statement of any business. It can be done automatically by our software system. The general ledger contains debit and credit entries for any type of transaction. So total debit balances always match total credit balances.

Subsidiary ledger

A subsidiary ledger maintains details for a general ledger control account. Subsidiary ledgers are used when there is a large amount of transaction information that would have cluttered up the general ledger. This situation can arise in companies with high sales volume, but there is no need for a subsidiary for a small company.

Journal

A journal is an act of keeping or making records of transactions that show your company’s debit and credit balances. A journal can be automatically created, validated, and posted based on spirited data from multiple sources. This feature helps you with a fully auditable trial and saves time at every step of your journal entry process. The journal entry consists of various recordings, which are either debit or credit. If the total debit or total credit is unmatched, your journal entry will be considered unbalanced. The Journal can be automatically validated, certified, and posted according to your rules, avoiding unnecessary errors and labor.

Trial balance

A trial balance is a report that provides the list of the ending balances of your general ledger accounts. This list will contain the names of each nominal ledger account and their nominal ledger balances. The debit balance list will be in the debit column, and on the other hand, the credit balance list will be in the credit column. The trading profit and loss statement, balance sheet, financial reports, and other transactions can be produced on the same balance. These features are used to ensure debit and credit balances.

Schedule of accounts

A schedule is a supporting report or document in the accounting system that constitutes additional details, information, or proof stated in a primary document. It’s also explaining the elements of the chief financial report with answers to all the numbers mentioned in the report. The schedule needs to provide proof for the general ledger and also provide additional details for contracts.

Income statement

An income statement contains details on revenue, sales, and expenses for a specific time period. Information like sales, cost of goods, operating expenses, etc., is all included on an income statement. These features primarily inform you of the amount of profit or loss your company generated during a given time period after all revenues and expenses have been deducted. They also provide a good snapshot of your company’s performance.

Balance sheet

In an accounting management system, a balance sheet is a summary of the financial condition of a company. This feature gives you a detailed breakdown of all your current assets, liabilities, and equity.

Profit and loss accounts

A profit and loss account (also known as a “P & L”) is an important feature that summarizes your business’s income and expenses over a period of time. This feature helps to measure the financial health of your business. This is the best way to determine if the company is profitable or not. It will display all of your income accounts, such as the services or products you sell, and also all of your expense accounts, such as payroll expenses and other costs. So this will easily compare and provide a company’s profit and losses over a particular time period.

Monthly income and expenditure reports

This tool manages your expenses and income in different bank accounts and also manages your money successfully by keeping a close eye on your expenses. This also helps you to track spending, create and manage a budget, and run reports over a month. It’s extremely intuitive to get professional-looking reports that enhance your work. So you get to know your monthly income and expenses and can also balance your profits and losses easily.

Reports

As a businessman, you always need to check your company’s growth periodically and have to make the right decisions at the right time to ensure your organization’s progress. So every report of your company is essential to understand your business’s financial trends and condition, and it will help to analyze growth patterns, income, profit, losses, etc. Accounting software generates all of your essential reports automatically and saves time and effort. Our system also compiles data automatically on other key aspects such as sales, purchases, taxes, inventory, projects, etc.