In today’s dynamic business environment, ensuring compliance with VAT regulations is not just a legal obligation but a critical factor in maintaining a company’s financial health and reputation. In Bangladesh, the Value Added Tax (VAT) system is integral to the nation’s revenue collection, making it essential for businesses to understand and comply with its regulations. However, non-compliance can lead to significant risks and costs. This blog will explore the implications of VAT non-compliance and how our VAT management software helps businesses avoid these pitfalls.

Understanding the VAT System in Bangladesh

The VAT system in Bangladesh is governed by the Value Added Tax and Supplementary Duty Act, 2012, and the Value Added Tax and Supplementary Duty Rules, 2016. Under these laws, businesses must register for VAT, issue VAT invoices, maintain proper records, and submit accurate VAT returns.

Key aspects of the VAT system in Bangladesh include:

- VAT Registration Threshold: Businesses with an annual turnover exceeding BDT 3 million must register for VAT.

- VAT Rates: The standard VAT rate is 15%, with reduced rates applicable to specific goods and services.

- Filing and Payment: VAT returns must be filed monthly, and payments must be made within 15 days of the end of the tax period.

Importance of Accurate VAT Management

Accurate VAT management is crucial for businesses to avoid the risks and costs associated with non-compliance. Proper VAT management ensures that businesses:

- Meet Filing Deadlines: Timely filing of VAT returns and payments helps avoid late fees and penalties.

- Maintain Accurate Records: Proper documentation and record-keeping support accurate reporting and reduce the risk of errors.

- Stay Updated with Regulatory Changes: Keeping up with changes in VAT laws and regulations helps businesses adapt quickly and maintain compliance.

How Our VAT Management Software “VATPro” Can Helps

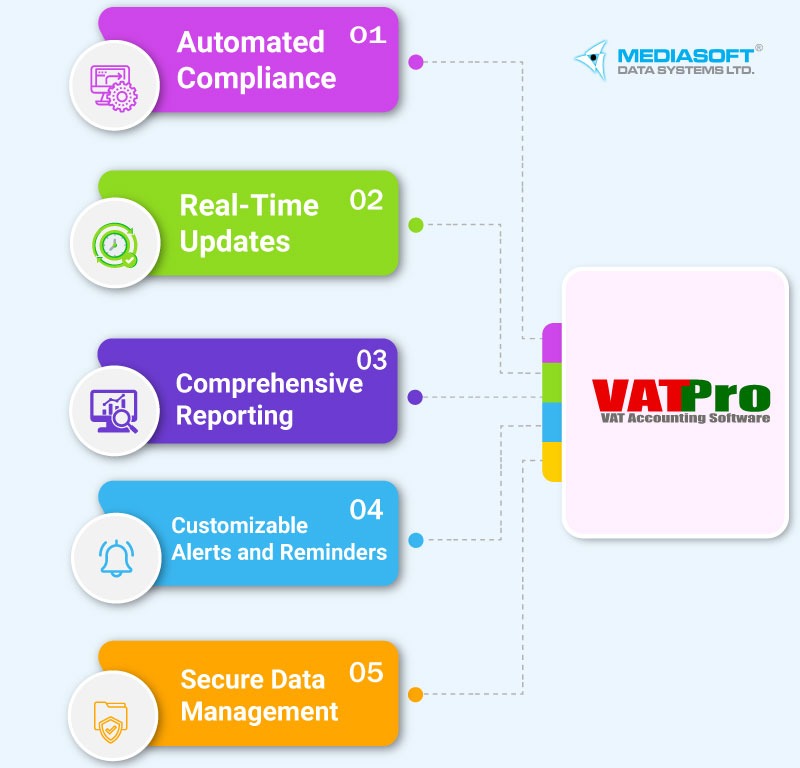

Our VAT management software VATPro is designed to help businesses in Bangladesh navigate the complexities of VAT compliance with ease. Here’s how our software can assist you:

- Automated Compliance: Our VAT software VATPro automates the calculation of VAT, ensuring accurate and timely reporting. This reduces the risk of manual errors and helps businesses stay compliant with filing deadlines.

- Real-Time Updates: With our software, you can receive real-time updates on changes in VAT laws and regulations. This ensures that your business remains compliant with the latest requirements.

- Comprehensive Reporting: Our software VATpro provides detailed reports on VAT transactions, helping you maintain accurate records and support your VAT filings. These reports are crucial during audits and investigations, providing evidence of compliance.

- Customizable Alerts and Reminders: Our software includes customizable alerts and reminders for filing deadlines and payment due dates. This ensures that you never miss a deadline and helps avoid late fees and penalties.

- Secure Data Management: Our software VATPro ensures the secure storage and management of your VAT data, protecting it from unauthorized access and ensuring its integrity.

Risks of Non-Compliance

Non-compliance with VAT regulations can lead to severe consequences for businesses, including:

- Financial Penalties: Non-compliance can result in hefty fines and penalties. For instance, failing to register for VAT or issue proper VAT invoices can attract fines of up to BDT 10,000 per instance. Additionally, underreporting or misreporting VAT can lead to penalties of up to 2% per month on the unpaid amount.

- Legal Consequences: Repeated or severe non-compliance may result in legal actions, including prosecution, which can lead to further penalties and potential imprisonment for responsible individuals.

- Reputational Damage: Businesses found guilty of non-compliance may suffer reputational damage, affecting customer trust and stakeholder relationships.

- Operational Disruptions: Audits and investigations resulting from non-compliance can disrupt business operations and consume significant management time and resources.

- Loss of Business Opportunities: Non-compliant businesses may face difficulties in securing contracts or partnerships, particularly with companies that prioritize compliance in their supply chain.

Conclusion

In conclusion, the cost of non-compliance with VAT regulations in Bangladesh can be significant, affecting a business’s financial health, reputation, and operations. Accurate VAT management is crucial to avoid these risks and ensure the smooth functioning of your business. Our VAT management software VATPro provides the tools and features necessary to streamline your VAT processes and maintain compliance, allowing you to focus on growing your business with confidence.